Here is the latest conversation I had with money manager Andrew Horowitz…. new insights for anyone who invests in anything.

Click here for non-Flash version.click ► to listen:

Right click here and select ‘Save Link As…’ to download the mp3 file.

Click here for non-Flash version.click ► to listen:

Right click here and select ‘Save Link As…’ to download the mp3 file.

The current housing bubble is supported only by the rock bottom interest rates propped up by Obama print money hand over fist. Eventually he will have to slow down the govt printing presses and then watch housing prices plummet.

Fortunately for homeowners, not. Unfortunately for savers. The inevitable result of ObamaPrinting is rampant inflation. Inevitable as in no historical case of a country printing money so blatantly without such end result. In rampant inflation prices of homes skyrocket. However, value of the money plummets. Another consequence of inflation is migration of the money into the “permanent value” stuff. Real estate is easily acquired “permanent value”. So, even in the inflation adjusted money, home ownership will be a net gain (how much is hard to tell, but except in blighted areas – certain gain).

Savers on the other hand will be robbed. Any saved money will be robbed by the force of Government printing.

Lived through two such vicious cycles abroad, similar results in other historical cases.

Estimate of the current, real inflation based on secondary effect on the market, not on the Government invented statistics: 12-15%. Raising since Bush-times. Inevitably.

In addition to printing money, the U.S. central bank will continue with its $85 BILLION a month asset purchasing program, the Fed’s Open Markets Committee decided at this week’s meeting.

The National debt is now 103% of the country’s GDP.

Not a pretty picture for real estate investors.

Again, historically – 100%+ debt to GDP always resulted in rampant inflation. Only example that confirms the rule is Japan – because of highly disciplined society they have succeeded in avoiding deadly crash of hyperinflation at the cost of semi-(mostly)-permanent stagnation, they crash-landed instead of just crashing. Still, there is no flying of that crash-landed airplane anytime soon. (Another part of Japan’s survival is in the fact that it is mostly domestic, private debt vs. foreign and self-produced by Government – that gives some feedback back to the economy). See housing prices in Japan (even without hyperinflation)…

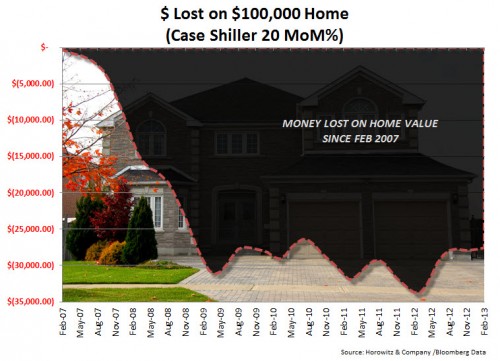

The graph is misleading. It starts at the top of the unsupportable housing bubble. A truer graph would start before the bubble started growing.

True, based on the home we purchased just before the bubble, value by 2007 was scary high. We just sold the home and still (!) got about twice+ the price in 2012 vs. in 2000. Definitely beat inflation or any other investment over the same period.

The housing bubble deserved to pop!! Everyone knew that

prices were “going crazy”, so what’s the surprise. People that paid more than a house is worth, buying houses that could be built for 1/2 the price they paid, had it coming.

They haven’t prosecuted any of the banks for setting the people up and milking the system and people of money. Like another post said, the money printing is propping things up and devalues the money that we do have. We saw prices of basic homes double here in Florida in about 2 years before the big pop!

That chart makes little sense to me. I just inherited a house. And the appraised value was about $6k higher than the County’s last assessment, for the past two years. Based on what other “similar” homes have sold for, in the area. Basically, I think the appraisal process is a lot of bull. If I tried to sell the house, I’d probably get no where near that appraisal value. But I’ll end up paying taxes, based on that bogus figure. And for that cron job, I had to pay out $325. I’m telling you the middle men, in every major transaction, have got it all sewed up, to benefit themselves. And the world is slowly being Agented and Brokered to death. Someday 99% of the jobs will be someone being the middle man for something, between the supply and the demand. And let see Adam Smith account for that.

You got it, Glenn. Here in Florida the tax man (and insurance companies) went out and appraised everyone’s houses at 200% their value. The banks could lend money on the houses based on “appraised value” and the insurance companies and state require you insure at FULL appraised value. It was all a government, insurance company rip off of citizen’s money.

The banks and middlemen all made money off us with the added tax of these excesses.