Federal regulators are poised to sue Jon S. Corzine over the collapse of MF Global and the brokerage firm’s misuse of customer money during its final days, a blowup that rattled Wall Street and cast a spotlight on Mr. Corzine, the former New Jersey governor who ran the firm until its bankruptcy in 2011.

The Commodity Futures Trading Commission, the federal agency that regulated MF Global, plans to approve the lawsuit as soon as this week, according to law enforcement officials with knowledge of the case. In a rare move against a Wall Street executive, the agency has informed Mr. Corzine’s lawyers that it aims to file the civil case without offering him the opportunity to settle, setting up a legal battle that could drag on for years. Without directly linking Mr. Corzine to the disappearance of more than $1 billion in customer money, the trading commission will probably blame the chief executive for failing to prevent the breach at a lower rung of the firm, the law enforcement officials said. If found liable, he could face millions of dollars in fines and possibly a ban from trading commodities, jeopardizing his future on Wall Street.

In a statement, a spokesman for Mr. Corzine denounced the trading commission for planning to file what he called an “unprecedented and meritless civil enforcement action.”

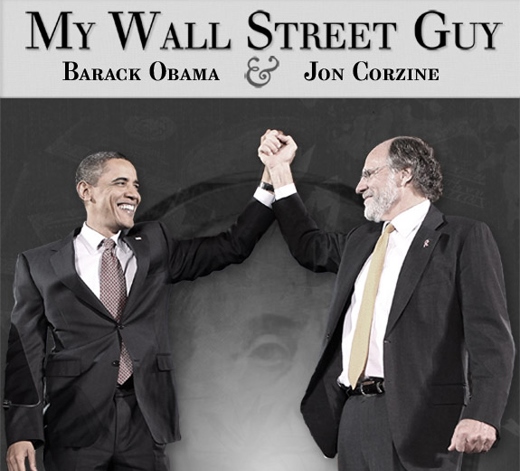

A case would darken the cloud over the legacy of Mr. Corzine, 66, who as a onetime Democratic governor and senator from New Jersey and a former chief of Goldman Sachs has long been a confidant of leaders in Washington and on Wall Street.

But it would also suggest that authorities have all but removed a greater threat: criminal charges. After nearly two years of stitching together evidence, criminal investigators have concluded that porous risk controls at the firm, rather than fraud, allowed the customer money to disappear, according to the law enforcement officials with knowledge of the case.

Still, the spokesman for Mr. Corzine, Steven Goldberg, said that the trading commission’s anticipated lawsuit “is not surprising considering the political pressure to hold someone liable for the failure of MF Global,” the largest Wall Street bankruptcy since the 2008 financial crisis. Lawmakers and even some agency officials, he noted, have publicly condemned the firm.

Millions in fines against over a Billion stolen….now that’s a good payday.

Meh, its a claw-back by the federal regulators.

Corzine had help, a lot of help, by the Wall street firms who were fleecing investors. (None of these bastards have gone to jail either.)

The regulators are in line for their share of the money. They’re lining the street in front of his garage before they line their pockets.

Well, what do you know. A POLITICIAN in trouble with the law. And a Democrat at that! I’m surprised and slightly amazed that anyone in the press was even WORKING since they almost never look for stories like this unless the “bad guy” is a non-Democrat (or they simply can’t ignore it).

However, I’m really wondering who got their (the press’s) collective noses in the wrong trough — er, “troff” (for those of you with less than a high school education) — to cover this story.

But then maybe the “repukes” simply ran out of sacrificial members when king Hollywood came looking for a “news story” that would help boost ratings.

In any case, yes! Less than a 10-percent return of STOLEN MONEY does sound like a good deal — FOR HIM! Funny how the press didn’t exactly focus in on that fact or WHERE all the stolen money went — as in WHO got most of it. (Probably didn’t want to loose their jobs or take a pay cut.)

Hahaha. So Corzine will be the “example” that Obama will use to try to convince the Sheeple that he is on their side and is quite willing to prosecute Wall St malfeasance. I’ll believe that line of BS when a Goldman Sux exec goes to jail.

I guess Obama is working overtime to deflect press attention away from the fact that he is conducting Espionage on 300 million Americans. And the taxpayers are paying for the infrastructure to have the govt spy on them.

“So Corzine will be the “example” that Obama will use to try to convince the Sheeple that he is on their side and is quite willing to prosecute Wall St malfeasance.”

From this I assume you wish Wall Street malfeasance to be prosecuted. If so, why was the creation of the Consumer Financial Protection Bureau opposed so strongly? Aren’t all regulations bad, evil, job-killing government intrusion?

Stand alone agency with its own budget and power to write its own laws. The agency is unconstitutional.

Corzine should be sitting in stir as a “flight risk” while a Grand Jury decides if he should be charged with embezzelment and market manipulation. Oh, and freeze his bank accounts as “ill-gotten gains”.

So over a billion dollars “disappears”, and all the FTC wants to do is fine some fall guy a few paltry million. That’s not punishment, that’s a slap on the wrist. Especially as it will get appealed until it’s not even that much of a fine. But the real question should be, why no jail time? EVER?! Just how big a theft has to take place, for any of these Wall Street crooks to serve a little time in stir? Not even hard time. Because they’d go to one of those executive, Club Fed, style prisons. Where they’d live no worse than most single military personnel do, on base or ship. I know of the four years of my military service. I felt as if I was a federal prisoner, much of the time.

So why shouldn’t these super crooks get to feel that way too? And maybe if the FTC actually made more of them serve as an example, in a prison. Then a whole lot fewer of their friends would be inclined to try and get away with wholesale fraud. But no, the elite are always privileged, and can serve time. More common people have gone to prison for YEARS, robbing someone of $5, with a toy gun. Than anyone has ever spend, locked away, over robbing hundreds of people, of thousands of dollars.

It’s like I’ve told people. If you’re gonna steal, steal something big. So at least it’s worth it, if they do catch and convict you. And just maybe if the theft is so great. It will embarrass them to have caught you. So they just pretend to try you, and then kick you out of court on some technicality. Like somebody forgot to read you your rights. Oops, case dismissed.

So over a billion dollars “disappears”, and all the FTC wants to do is fine some fall guy a few paltry million. That’s not punishment, that’s a slap on the wrist.

A million is 1% of a billion. If they fined him up to 99% of the disappeared billion, he’d still retire to a private island and be set for life.

He’d have a up to a million more more than the average 99%er, who’s maybe two paychecks away from calamity, does.

Will never go to jail because they always employ the very very best lawyers. They make blatant thieft legal. Of course everybody else can never do this. Rulers of the universe they are!

John Corzine should be doing hard time in a maximum security prison.

Greet the “new” boss! Same as the old boss…

At least the Who were inspiring. And now a good song is stuck in my head…